Salesforce has agreed to acquire Informatica for approximately $8BM.

Bloomberg hinted at the news late last week, citing “a person familiar with the matter”.

Salesforce was linked to a move for Informatica in early 2024, but cooled its interest after reportedly failing to agree on an acquisition fee.

Yet, since the move broke down in April last year, Informatica’s stock price has dropped by over a third, and Salesforce has now swooped.

The deal will – which is worth roughly $8BN in equity value – will see holders of Informatica’s Class A and Class B-1 common stock receive $25 in cash per share.

Explaining the company’s motives for the deal, Marc Benioff, Chair and CEO of Salesforce, said:

Together, Salesforce and Informatica will create the most complete, agent-ready data platform in the industry.

“By uniting the power of Data Cloud, MuleSoft, and Tableau with Informatica’s industry-leading, advanced data management capabilities, we will enable autonomous agents to deliver smarter, safer, and more scalable outcomes for every company, and significantly strengthen our position in the $150 billion-plus enterprise data market.”

Investors did not react kindly, with Salesforce’s stock down by over three percent on the news.

However, there is a method to the madness, as Informatica could bolster Salesforce in several ways. The following big talking points underscore why the acquisition is set to go through at the second time of asking, beyond: it’s cheaper now.

1. A Move to Primarily Improve Data Quality

The deal signals that Salesforce customers need more assistance in managing data to maximize the ROI of Agentforce.

These customers have likely struggled to link Agentforce with backend data that isn’t in Salesforce or stored cleanly. That makes taking AI agents beyond specific functions challenging.

Of course, Salesforce already has Data Cloud. However, unless businesses have clean data sets feeding into their data platforms, they won’t establish a value-generating data pipeline.

Informatica can help here. It serves the entire organization, not just the front office. In doing so, it overlays a robust data validation framework across the enterprise.

2. Informatica Adds Critical Tools for the $150BN+ Enterprise Data Market

As alluded to, Informatica brings data quality controls and policy management. These capabilities will help ensure that he data driving AI is accurate, consistent, and secure.

Yet, there are also some other features that Salesforce doesn’t already offer with its Data Cloud, MuleSoft, and Tableau trifecta.

For instance, Informatica brings advanced integration and cataloguing tools. These help highlight where data has come from, how it has changed, and how it’s utilized, enabling superior data governance.

Informatica also houses enterprise metadata, which will bolster AI agent deployments, feeding them with more context to act on.

While there is a lot of overlap still, Amit Walia, CEO of Informatica, assured onlookers:

We have a shared vision for how we can help organizations harness the full value of their data in the AI era.

3. Salesforce Is Pivoting to Serve Enterprise IT

Recently, Jenson Huang, CEO of NVIDIA, painted a picture of IT teams having observability over enterprise systems, curating, managing, and improving AI agents.

In this sense, IT teams will oversee everything. In doing so, they’ll monitor agent adoption, track ROI, and govern.

That vision, from the world’s foremost AI thought leader, challenges Salesforce. After all, it usually sells to CX leaders, not IT leaders.

Perhaps recognizing this challenge, Salesforce recently confirmed a big move into IT service management (ITSM).

Informatica, which supports enterprise IT, not Salesforce’s traditional model of embedding accessible AI solutions, may aid the CRM leader in selling to these IT buyers.

What Are the Potential Downsides?

Outside of specific data understanding, prepping, and validation tools, there’s significant overlap between Informatica and Salesforce, especially regarding MuleSoft.

Navigating the merger would be so complex that Gaurav Dhillon, the co-founder of Informatica, warned last year that it could take five years to complete.

If this is indeed the case, it may have been much cheaper and more efficient for Salesforce to snipe talent from the company to build its own enterprise data validation framework.

Indeed, while the acquisition may be less expensive than 12 months ago, $8BN is still a lot of money to only utilize a portion of what it does (and its skilled engineering team).

Additionally, Informatica loses its reputation as the Switzerland of enterprise IT now that the acquisition has gone through, meaning some of its customers could look elsewhere.

Lastly, it’s critical to note Salesforce’s recent mixed merger and acquisition (M&A) success.

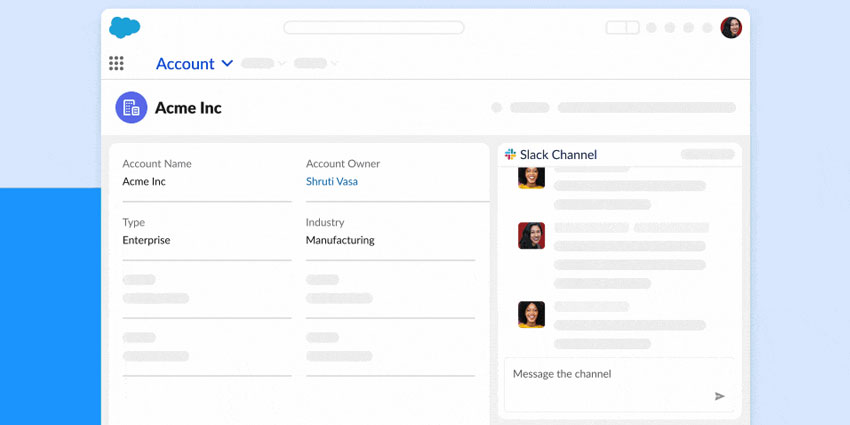

While it has worked wonders to turn Airkit.ai into the Agentforce product it is today, its struggle to convert Slack into the “Digital HQ” for the enterprise and Vlocity into an industry cloud powerhouse looms large in the memory.

CX Today first published this article on Monday, May 27, to debate the possibility of Salesforce acquiring Informatica. It has since been rewritten to denote the change in the deal’s status.